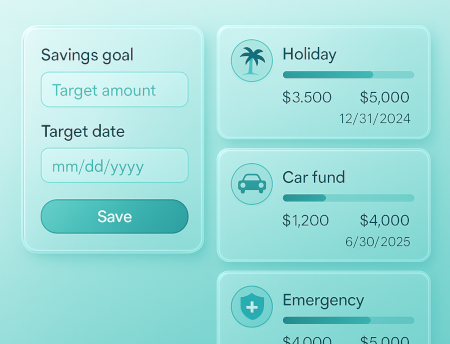

Real examples of savings goals

Common goals our users create:

Emergency Fund

- €1,500 by June

- Weekly €75 deposit

- Interest as separate contribution

Holiday 2026

- €2,000 by March 2026

- Monthly €150 deposit

- Milestones every €500

Car Fund

- €3,500 by December

- Side-hustle income only

- Pause during school holidays

Home Repairs

- €1,000 rolling

- Top up when under €400

- Label invoices in notes

New Laptop

- €1,200 by Black Friday

- Round-up deposits

- Track accessory costs separately

Education

- €2,400 per year

- Quarterly €600

- Scholarship credits as contributions

Who this works best for

Busy families

Turn irregular expenses-holidays, school trips, repairs-into planned goals with steady contributions.

Solo households

Build an emergency buffer and fund big purchases without derailing the monthly budget.

Side-hustlers

Allocate a portion of freelance income toward tax, equipment and training goals with clear timelines.

GoTaskhub Goals vs spreadsheets

| Feature | GoTaskhub Home Goals | Spreadsheets |

|---|---|---|

| Progress tracking | Automatic with each contribution | Manual formulas & charts |

| Multiple goals | Side-by-side with timelines | Tabs and templates to maintain |

| Milestones | Visual checkpoints built-in | DIY rules or conditional formats |

| CSV portability | Clean import/export | Prone to column drift over time |

| Works with budgets | Integrated with monthly plan | Separate sheets to reconcile |

Pros & cons of GoTaskhub Goals

Pros

- Clear targets with visual progress

- Multiple goals with timelines and milestones

- CSV import/export keeps data portable

- Works alongside Budgets, Expenses, Analytics

Cons

- Requires short, regular check-ins for best results

- Advanced analytics available with Pro

Security & privacy

Permissions

Invite a partner with view or edit access. Each workspace is permissioned so your household stays in control.

Data ownership & backups

Export goals and contributions to CSV anytime for backups or analysis. No lock-in-your savings history is yours.

Glossary

- Target amount

- The total you aim to save for a goal.

- Target date

- The date you want to reach your goal by.

- Contribution

- A deposit toward your goal (including interest credits).

- Milestone

- A checkpoint (e.g., 50%) used to celebrate progress and stay motivated.