Best practice: keep budgets “boring”

The most sustainable budgets don’t rely on willpower. Set realistic limits, do a five-minute weekly check-in, and tighten gradually using Analytics to find the easiest wins.

- Keep category names stable (clean comparisons)

- Adjust calmly mid-month (no “budget blown” spiral)

Who this works best for

Busy families

Turn groceries, childcare, and recurring bills into predictable limits. Share progress with a partner without sharing bank credentials.

Solo households

Plan fixed bills and flexible spending with calm, predictable limits. Keep it simple and adjust as life changes.

Side-hustlers

Keep personal budgets tidy while setting savings targets for tax or equipment. Use Analytics to make the next month smarter.

Example monthly budgets

A few common category limits to help you start quickly:

Groceries

- €400

- Weekly shop + top-ups

Transport

- €120

- Fuel or public transit

Utilities

- €180

- Electricity, gas, water, internet

Dining Out

- €120

- Meals & coffee outside

Subscriptions

- €40

- Streaming & cloud storage

Miscellaneous

- €100

- Gifts, odds & ends

GoTaskhub vs envelopes & spreadsheets

| Feature | GoTaskhub Budgets | Cash envelopes / Spreadsheets |

|---|---|---|

| Live progress | Automatic with each expense | Manual math & updates |

| Adjust mid-month | One edit; history intact | Rewrite sheets or re-label envelopes |

| Household sharing | Invite partner with permissions | Passbook or shared file hassles |

| Analytics | Built-in trends by category | DIY charts & pivots |

| Portability | Clean CSV exports | Often messy formats |

Pros & cons of GoTaskhub Budgets

Pros

- Real-time progress and remaining amounts

- Mid-month edits without breaking history

- Works with Expenses, Goals, Analytics

- CSV export keeps your data portable

Cons

- Requires a quick weekly check-in for best results

- Advanced analytics available with Pro

Security & privacy

Permissions

Invite a partner with the right level of access-view or edit. Each workspace is permissioned, so you stay in control.

Data ownership

Export to CSV anytime for backups or analysis. No lock-in-your budgeting history is yours to keep.

Glossary

- Budget limit

- The maximum you plan to spend in a category this month.

- Remaining

- Budget limit minus the sum of category expenses so far.

- Roll-over

- Carrying leftover amount into the next month’s plan (optional).

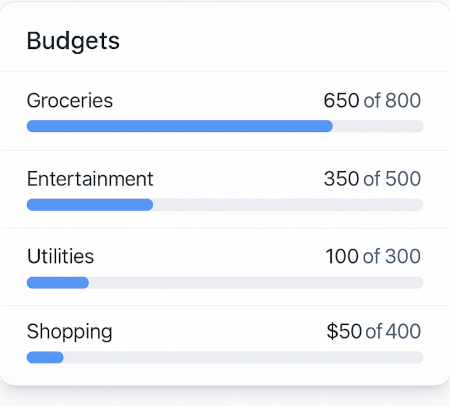

- Progress bar

- A visual indicator showing how much of a category limit has been used.

What users say

Emma L.

Manchester, UK

“The remaining amounts make it obvious where to slow down. We’re finally under budget two months in a row.”

Luca P.

Milan, IT

“Editing limits mid-month is a lifesaver. No guilt spiral-just adjust and keep going.”

Sofia R.

Lisbon, PT

“Budgets + Analytics made our grocery plan realistic. We save ~€90/month without feeling it.”